7 Ways To Get Your Budget Back On Track After The Holidays

The holidays can be a very stressful time. There are so many things to buy, places to go, people to see, things to do, and parties to attend. Most of these activities require a gift, food, or money. During the holidays, it’s so easy to throw your budget out the window and overspend on purchases. And before you know it, you are broke. Your extra money is gone, and you are left with a lot of bills.

So, how do you Get Your Budget Back on Track after the Holidays are Over? I have listed 7 ways to help you with this task. They are not difficult and will require a “little” work, but they will help you financially.

Read each one first. Then get busy. Create a budget, use only cash, get organized, shop wisely, eat at home, start saving for next year, and pay off debt. Just dive in and get busy. As long as you are working on getting back on track, not spending more money, and getting things done, you are on the road to getting your budget back in order.

If you are looking for some inspiration, this should help. Do you feel empowered to make a change?

Let’s work together and Get Your Budget Back on Track. Ready? Let’s Go!

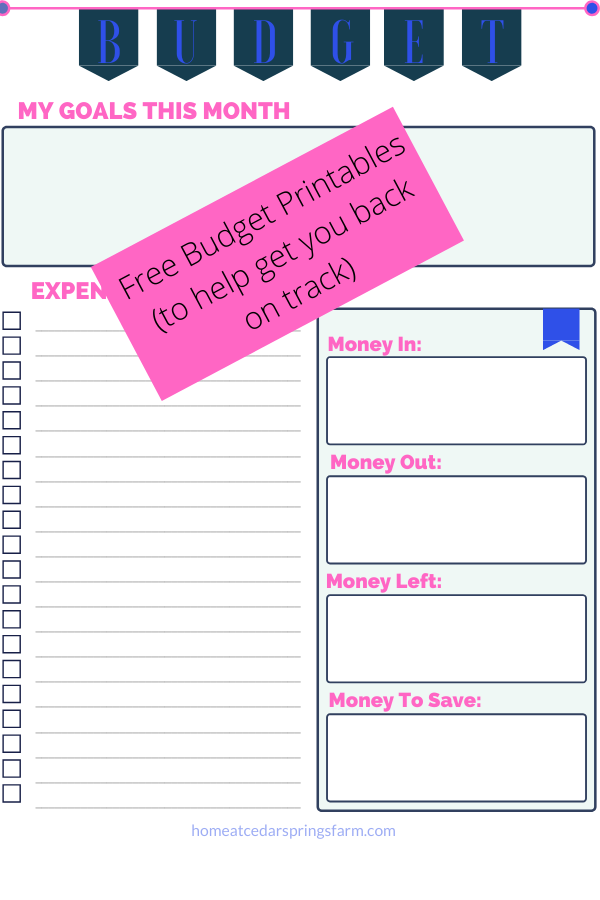

Be sure to subscribe to my email list and get your FREE printables to help you budget your money.

Don’t try to do it all at once. First, make a list. What are your plans for the year? Your goals? This is the perfect time to get your finances in order. Do you want to start a savings plan? Are you planning on taking a vacation this year? You decide. Just breathe. Make a plan, and it will happen.

Create a Monthly Budget

This is not that difficult. A budget is just a plan of how you will save money. If you don’t make a budget, you will be wondering where you spent your money.

Write everything down that you will spend during the month and year. Be sure to take into consideration birthdays and holidays such as Mother’s Day, Father’s Day, Easter, Christmas, etc. Ask yourself these questions–How many times will you eat out? Will you have a date night with your spouse? Will you go to the movies? Not sure? Go ahead and add a little extra into your budget if you think this might be something you will do.

It’s better to have a little extra set aside to spend on “fun” things. Just remember, IF you don’t spend it this month, carry it over to the next month or add it to your savings plan. Win-Win!

Look for way to save money during the month on necessary items. Look at weekly sales papers or online ads. It is worth the time to compare prices when shopping. With the rising cost of groceries and EVERYTHING for that matter, comparing prices can save you bucks at the register.

Check out Creating a Monthly Budget and Sticking to it for more tips on getting your finances in order.

Develop a Cash Only System

If you are trying to recover from the holidays, this is a step in the right direction. Put away your credit cards. No plastic allowed for this step. If you are trying to recover from debt, quit adding to your balance.

Using cash will make you more aware of what you are spending. It is easy to hand over your credit card for purchases, but using cash will make you think about your purchases more. I know when I am using cash, I tend to think about what I am buying, and if I really need that item.

Get Organized

After you create a budget, it’s time to get organized. This includes finances, groceries, paperwork, pantry items, and closets.

Organize your pantry. Don’t just go out and buy unnecessary items. Check out your kitchen pantry before you head to the grocery store. I bet you can find enough food in there for several meals. You will be amazed at the meals you can make with a box of mac and cheese and chili beans.

Organize your closet. Don’t buy any clothes until you have gone through your closet several times. Pull out what you are not wearing, have not worn in several years, and clothes you never plan to wear again. Have a yard sale. This is a great way to bring in a few extra dollars during the month.

Organize your cleaning supplies- I like to keep an eye on my cleaning supplies. When I have a few minutes to clean, I don’t want to be out of something I need. If I see I am running low on furniture polish- I write it down. If my washing detergent is getting low- I write it down. On the other hand, you might also realize you have 2 bottles of Windex and 6 boxes of dryer sheets in your cleaning closet. Not that I am guilty of this.

For more tips on cleaning your home, check out How To Speed Clean Your Home.

Shop Wisely or Stop Shopping

If you don’t need it —Don’t Buy It! Simple!

Always make a list when you head to the grocery store. This will keep you focused and on budget. Only using cash at the grocery store helps me to stick to my list and not overspend on impulse items.

With the convenience of the internet today, it’s easy to sit down and order just about anything on the computer. Don’t be tempted to do it! An easy way to fix this problem is to stop shopping. This includes online shopping as well. This goes back to the step above–No Credit Cards!! You can do it!

Eat at home

Yes, eating at home can save you a lot of money each month. Check out my post on How to Stop Eating Out So Much. We took a monthly challenge to stop eating out for a whole month and saved over $400. I know.. Crazy! Right? Eating out can add up during the month. Just stopping to get a hamburger and fries can cost nearly $10.

Pack your lunch. Here are some lunch box ideas. Get creative. Use your Crockpot. Plan ahead and save money this month. This would be a great way to put some money away and save for a vacation. Be sure to check out my post How To Stop Eating Out So Much for more ideas on eating at home.

Be sure to subscribe to my email and grab my FREE printable Monthly Menu Calendar. You and your family can write down your dinner options for the month. This is a great way for you to be prepared each week and help you not overspend at the grocery store. This will also help you stay focused and not stop by for fast food for dinner.

For more crockpot ideas, check out this post here and here.

Start Saving

Start Saving For Next Year-Create a Holiday Savings Plan. Don’t let the idea of saving money scare you. You can put away a little money each week and have a surprising amount saved by the end of the year. Just a few dollars a week can add up.

Instead of eating out, pack your lunch and take that extra money, and save it. You might be amazed by the amount of money you have saved within a few months. Instead of going to the movies–find something on Netflix. Look for free things to do in your community. Go to the park. Ride bikes. Take a walk. You get the idea.

If needed– start small. Some people like to save their change. Change adds up. Cash it in at the bank for dollars and tuck those dollars away. My children do this. They are amazed with how fast their change adds up and the money they save by doing this.

I know several people who save all of their $5 bills. Every time they get change back, and it has a $5 bill–it goes to their savings jar. You can come up with a plan that works for you. Start small or Go BIG. The choice is yours.

Have money automatically transferred from your checking account to your savings account once a month. Again, start small. Every little bit helps and adds up quickly.

At the end of the year, you will be so glad you decided to save. Here are a few examples of some different savings plans. Be sure to check them out and see if one might work for you.

For more tips on saving money, check out 31 Money Savings Tips.

Pay Off Debt

Pay Off Debt from THIS year BEFORE you add MORE to it!

Yes, paying off debt should be at the top of your list. Don’t let more debt add up before you decide to tackle what you already have. Look at your credit card bills. What can you pay this month? Can you double that amount? Pay off what you can as fast as you can.

Interest rates are strong, and they add a lot to your bill each month. Need extra money? Have a garage sale. Sell some items online. Look in your child’s closet. What have they outgrown? Can you sell it? Do you have an exercise bike or treadmill in your basement you are not using? Sell it. These are just a few items people are looking for every day.

In Conclusion

Working on these items is an excellent way of taking back your finances. The choice is yours. Keep chipping at it. Keep working on it daily/ weekly/ monthly. You can do it, and you will be so glad you did.

Be sure to sign up for my e-mail list and get 7 FREE printables to help with your monthly budget.

Wow, saving over $400 in one month by not eating out is very motivating indeed. Thanks for the tips.

You are welcome! Eating out is expensive. We did not realize how much money we were spending until we took the challenge of not eating out for the month. This is a great way to save for a vacation! 🙂

The holidays can leave the bank account a lot lower.. these are great tips for getting back on track. My goal is to try to get the food budget lower and save money by eating at home.

Eating at home will help a great deal with the food budget. Eating out is so expensive. You can do it! 🙂

It’s so hard for me to go cash only! But such great suggestions! Thanks for sharing!

You are welcome! Thanks for the comment.

This is the first year ever, I actually stayed on budget!! And I was so happy!!!!

Great!!! Keep it up!

Eating at home has been one way we save money. That and sticking to a meal plan and grocery list. It is amazing how much we can spend on food if we let ourselves!

Yes, it is so easy to buy impulse items at the grocery store. I have to make a list before I go to the store. I don’t trust myself without one. 🙂

This is so helpful this time of year! The holidays always completely derail my budget!

January is always a tough month, but also the perfect month to get busy saving. Thanks for the comment.

Amazing what you can accomplish and save by getting organized. I love your tip on cleaning out the knicks and crannies to see what you already have. I am so guilty of needing to do this before I run out and purchase things, or should I say often repurchase things. Lol

Yes, you might be amazed with what you already have on hand. Organization is a great thing to do around your home. 🙂

Great tips! It can be hard after the holidays 🙂

Thank you! 🙂

Just being aware of how much is going towards certain areas is so helpful! We have a program through our credit union that groups everything together into categories and then we can set limits and get notices if we get too close to the budget we set. It’s so helpful!

Wow! That’s great! I bet that would be super helpful!

I love these tips.. and especially saving a particular note like 5dollars when you have it. My new year plan is to completely not but any new clothes in 2020 l have too much! Hope l.stick to it.

Yes, just cutting back in small ways will save big bucks in a year’s time. You can do it!

We often have a lot of these issues after the holiday so these are great tips to keep in mind. Thanks for the thoughtful post!

You are welcome! Thanks for stopping in!

These are all useful tips to recover from the financial onslaught during the holidays, thank you!

You are very welcome!

Love your tips! I always do a no spend January and by doing this it helps me pay anything on my credit cards from holiday shopping and the previous year.

Sounds like you have a plan in place. 🙂

I love this post! Thanks for sharing all these helpful tips. I always make a list when going shopping, it’s so helpful as it prevents me from waisting money on unnecessary things, it also helps me to get everything I need xx

Thanks so much! Making a list has saved me a lot of money.

Great post. Very insightful

🙂 Thank you!

Eating a home has been such a big money saver for us! Thanks for these great tips to keep a budget on track!

You are welcome! Thanks for stopping by.

Great post!

Love the printable too!

I never would have thought that being organized has anything to do with your finances but it’s a great tip and absolutely makes sense the way you explained it!

I was surprised at how much money we saved by eating at home during the pandemic- something we will definitely continue to do! Great post 🙂

Nice budget printables! I appreciate all of the tips you gave. I can definitely benefit from having more organization in our family finances. Thanks for the post!

100% I agree that eating at home, or even making your own food to take into the office really saves money. I used to eat out a lot and not only was that bad for me and my health but it also had an impact on my savings. While I was not spending a lot it definitely is something that can be cut down on.